Strategy is Everything

Put simply, a mandate is a strategy or investment plan that is implemented either immediately or over time.

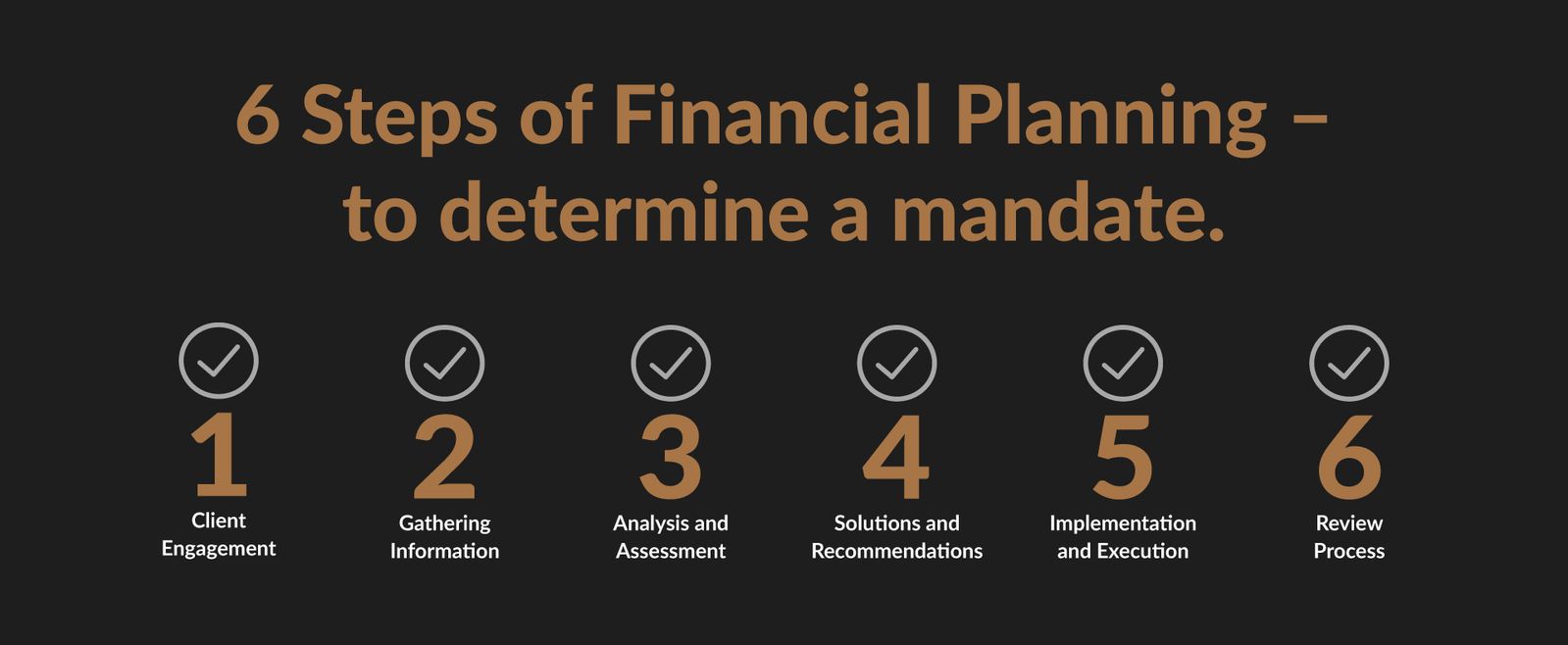

When meeting a new client, the primary objective is to determine the appropriate investment plan, or mandate, for that client. To do this, we embark on what is referred to as a needs analysis. This helps us determine a suitable mandate, which ultimately guides us in setting up phase one of the portfolio construction process. The mandate is often referred to as the Big Picture and is closely aligned with the asset allocation of the portfolio. If this is done correctly, all that’s required to reach your goal is time. There are typically six steps that we go through with potential clients to ensure this process is done correctly.

“It’s about time in the markets, not timing the market."

These are the types of mandates that we manage for clients.

Local Mandates

| Investment plan | Cash plus | Cautious | Balanced / Moderate | Growth | Aggressive |

|---|---|---|---|---|---|

| Equity exposure | 0% - 5% | 5% - 35% | 35% - 60% | 60% - 75% | 75% - 95% |

| Target | CPI +1% | CPI +2% to 3% | CPI +3% to 4% | CPI +5% | CPI +6% |

| Investment horizon | 12 months | 3 years | 5 years | 7 years | 10 years |

| Type of mandate | Ultra conservative | Conservative | Balanced | Growth | High risk |

Direct Offshore

| Investment plan | Cash plus | Cautious | Balanced / Moderate | Growth | Aggressive |

|---|---|---|---|---|---|

| Equity exposure | 0% | 5% - 35% | 35% - 60% | 60% - 75% | 75% - 95% |

| Target | N/A | CPI +2% | CPI +3% | CPI +4% | CPI +5% |

| Investment horizon | 12 months | 3 years | 5 years | 7 years | 10 years |

| Type of mandate | Ultra conservative | Conservative | Balanced | Growth | High risk |

The mandates are constructed using one platform and multiple underlying active investment managers.

If you want to explore the options around constructing passive portfolios within different mandates, this is also a possibility.

The high-risk mandate, which can be 100% exposed to equities, can be managed either via a unitized fund or direct shares, both locally and/or globally.

The appropriate mandate extends to both voluntary savings and compulsory savings. Within the compulsory savings space we can manage preservation funds, retirement annuities and living annuities. We are also able to set up tax-free retirement savings accounts. In certain instances, if the size of the portfolio warrants it, the use of direct share portfolios can be used within living annuities.